This material was first published on the media: Forbes.pl

This material was first published on the media: Forbes.pl

What does responsible lending mean at TAMGA Fintech?

Fintech company TAMGA has long promoted responsible lending in the market.

By definition, responsible consumer lending is tailored to the needs and allows to avoid excessive consumer indebtedness. Not just for the average and general, but for every consumer applying for a loan.

Fundamentally, such a definition is a requirement for any lender to refuse the pursuit of only their own benefits and to consider the interests of the recipients of their services. Responsible lending is therefore one of the basic and exemplary concepts of consumer protection. For many people with a post-socialist background and a certain allergy to social issues, such requirements sound utopian and unacceptable.

Why do we benefit from this?

At TAMGA, we propose to get rid of prejudices and try to understand why some companies are more strict with borrowers or debtors: they try to grant a loan to everyone, and then find it equally hard to recover it, while TAMGA introduces responsible lending requirements in its products. Also, why it is profitable for us, as such steps reduce credit costs, have a positive impact on the financial well-being of citizens, and stimulate economic development in the countries where TAMGA is developing its products.

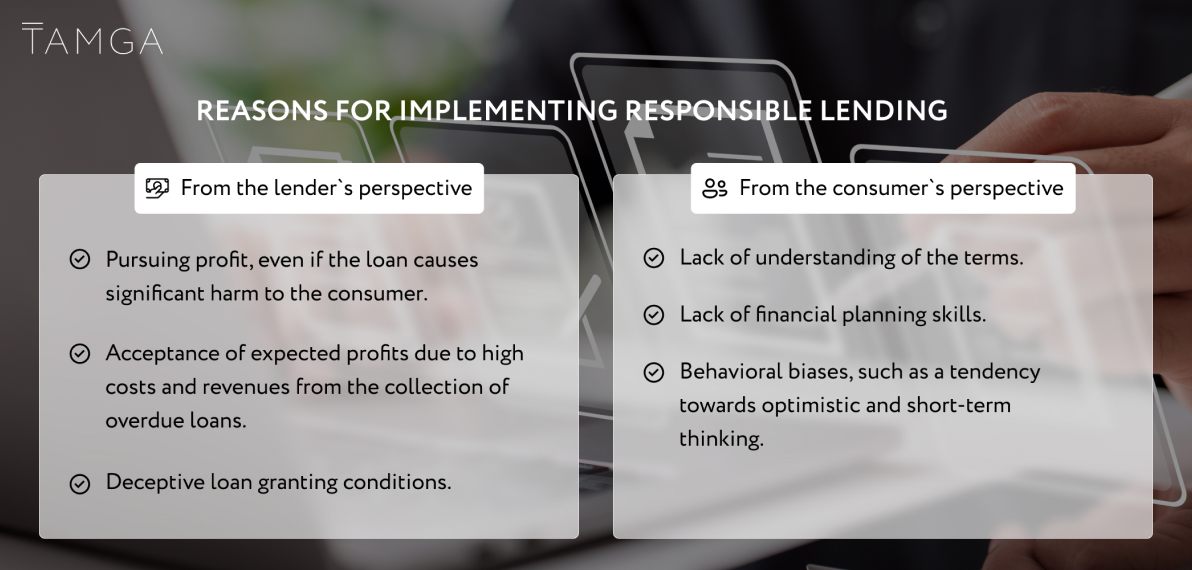

Reasons

Consumers may make credit decisions with a high probability of future insolvency due to a lack of understanding of terms, confusing loan conditions, a tendency towards optimism and short-term thinking, and other biases. Financial education and literacy can reduce the impact of these causes, but cannot eliminate them. Understanding this and analyzing the reasons for clients' delays, TAMGA experts worked on the development and implementation of responsible consumer loans in their products in accordance with the recommendations of the World Council for Financial Stability. In 2011, the Council acknowledged these efforts as justified and supported companies that implemented them.

In a broad sense, responsible lending encompasses the entire cycle of the lending process from advertising to full repayment and includes 7 elements, the key ones being the verification of sufficient creditworthiness and ensuring that the loan terms meet consumer needs (appropriateness). In this sense, responsible lending in the EU became a universal requirement for all banks and financial companies in May 2020.

In our credit products, we thoroughly analyze the creditworthiness of borrowers. However, this does not mean that we are obliged to refuse a loan if there is no evidence of sufficient creditworthiness. This is exactly what responsible lending is about. In every individual case, the consumer must be convinced that they are able to repay the loan without financial difficulties in the future. In TAMGA, this approach resembles the ethical principle of "do no harm".

Related materials:

Discover TAMGA's transformative role in the lending sector with their innovative, machine-learning platforms. Experience seamless transactions and personalized lending solutions where innovation meets convenience. The future of finance, today!

10+ Years of Sustainable Development in the Financial Services Market >>

Trace TAMGA's decade-long journey of innovation in the fintech landscape. From its inception in 2011 to becoming a key player in Europe, discover TAMGA's role in shaping the future of financial services. Stay tuned for the next chapter in sustainable market development!

How an I.T. worker can move to the UAE in 2023 >>

Discover the step-by-step journey of relocating to the UAE as an IT worker in 2023! Learn the ins and outs of the Digital Nomad visa application through personal experience and kickstart your adventure in the world's burgeoning tech hub!

Stay ahead of innovation: TAMGA services and technologies >>

In the last decade, digital tech has reshaped the financial sector and personal experiences dramatically. Anticipate even faster industry growth ahead. Discover the future of FinTech and the upcoming driving forces in financial services in today's article.

Responsible Lending: Empowering Consumers and Promoting Financial Literacy >>

We believe lenders shouldn't use invasive marketing or offer unaffordable products. Lenders shouldn't mislead with fine print. Our customer-centric approach goes beyond just processing requests through tech support.

ChatGPT and other neural networks instead of a marketer? Easy! TAMGA's positive fintech experience >>

AI influences startups and homes. ChatGPT with GPT-3.5 transformed creative content creation. Widely used, it reduces writing time by 80%. TAMGA uses ChatGPT for tailored content.

From June 6th to 8th, one of the largest fintech conferences, Money 20/20 Europe, took place in Amsterdam. Tamga gathered the most interesting insights and identified five trends worth paying attention to in the near future.

Opportunities and limitations of scoring in consumer lending industry >>

Explore the dynamic landscape of scoring in the consumer lending industry. Unveil the opportunities that foster growth and innovation, while understanding the limitations that govern this sector. Step into the future of informed lending practices with us.

Metrics in the credit scoring system: how do they relate to money? >>

Unlock the intricacies of credit scoring with our deep dive into metrics and their connection to monetary matters. Learn how numerical assessments can influence your financial prospects and how to navigate the complex world of credit with ease and insight.

Fintech is coming. Why traditional banks are doomed >>

The digital economy is the main worldwide trend. Right now, we are witnessing a real technological revolution and the start of the Fourth Industrial Revolution. Companies from the segment of financial technologies make traditional banks obsolete and unnecessary. And that is just the beginning.