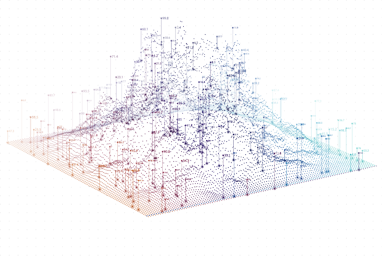

Data acquisition from

social networks, telecoms

and other open source

Information processing with

Big Data technology approach

Data classification

Data aggregation

Absence of comprehensive approach to risk management is a big problem for many companies. Often they do not even have special employees which could be involved in risk control, and third-party services are used for application scoring.

Risk management is the blackbone of Tamga. We have the separate department that is specialised on risk model development for different businesses. It operates several thousand parameters, depending on the customer’s data, depending on the type of customer and availability of data about it in various open sources.

From the entire data set, using tools of Machine learning, our scoring model choose the most powerful factors affecting the scoring process. In our decision engine multiple scoring models are used, that allows us to differentiate unprofitable and profitable customers.

Multiple parameters

Automatic selection

of the strongest factorsTamga has developed own solution for online tracking of frauds and disreputable customers, analyzing information about borrowers in real time.

Within the decision-making process, the system analyzes IP, behavioral factors, customer geolocation, device tracking, searches for matches among other borrowers, validates addresses and data. This provides possibility to automate completely the borrowers scoring process.

Mobile apps are a new level of interaction with the client. By 2020, global mobile app downloads will reach 284 billion. Can your business really afford to stay out of the game when those kinds of numbers are in play?

Tamga develops mobile applications for online markets, banks, loan companies. With our help, you can be just in one touch from your customers.